Article

Jan 28, 2026

AI in Private Equity Due Diligence

Learn how Private Equity firms are using AI in due diligence with practical steps, real tools, and examples that work without needing a tech team.

Why AI in Private Equity Due Diligence Changes Everything

Private equity due diligence has worked the same way for decades. Analysts spend hours on spreadsheets, reviewing hundreds of documents, and racing against deal deadlines.

AI is changing that reality faster than most firms realize.

The funds that used to rely entirely on manual work are now completing diligence in half the time. They are also able to surface risks earlier and discover insights that human analysts often miss when overwhelmed with volume.

And no, we are not talking about replacing your team. It is about practical AI for private equity, and in this playbook you will learn how to implement it step by step, even if you do not have a data team or coding skills.

What Is the Role of AI in Private Equity Due Diligence?

AI in private equity due diligence refers to using machine learning and natural language processing tools to automate repetitive analysis tasks, extract data from documents, and surface patterns across large datasets that would take humans weeks to process.

Your analysts are not going to get replaced by AI. Instead, AI removes the manual work that slows due diligence down and frees your team to focus on higher ROI tasks.

In practical terms, AI can:

Read and summarize more than 200 documents in minutes

Pull and clean financial data from PDFs or Excel sheets

Surface red flags in contracts, HR data, or customer reviews

Predict future performance using pattern analysis

The key is knowing where to apply it, not how to build it.

What Are the Traditional Due Diligence Bottlenecks?

Before getting into the tactical side of things, it essential to understand where most mid market funds lose efficiency in due diligence:

Manual data collection from multiple systems. Teams often spend days pulling information from different sources before any analysis can begin.

Inconsistent document review. Contracts, NDAs, and customer data get reviewed at different speeds and depths depending on who handles them.

Slow competitive and market intelligence gathering. Researching the target's market position often takes longer than it should.

Poor insight synthesis. There is too much data and not enough clarity when it matters most.

AI tools directly address each of these four bottlenecks.

The PE AI Fit Map: A Simple Framework for Where to Start

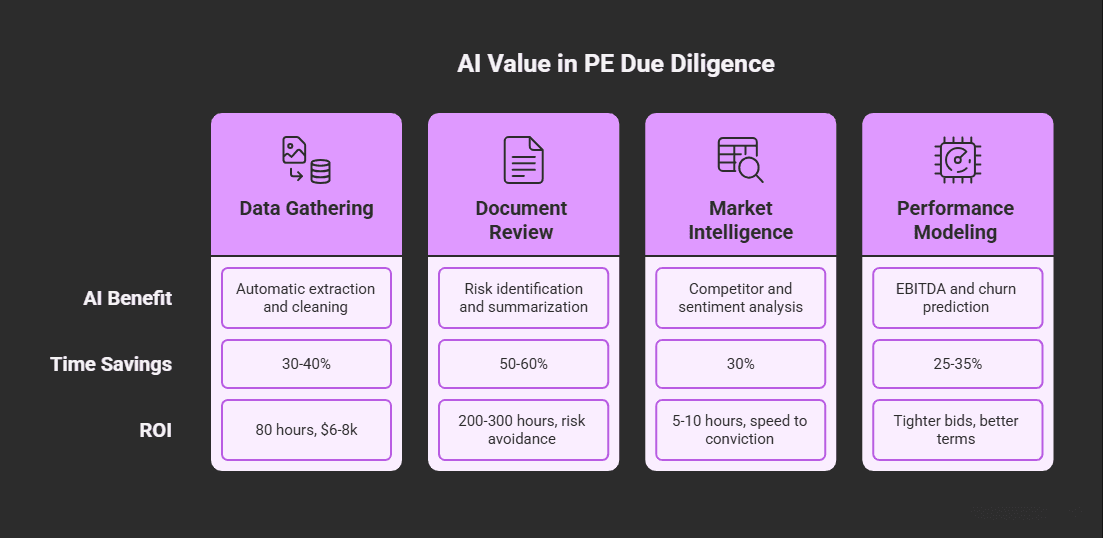

Think of this as your Due Diligence AI Roadmap. It is a four part framework to identify where AI adds value fastest in your process.

Data Gathering

AI can extract and clean financial or operational data automatically. Tools like ChatGPT, Docsumo, and Excel Copilot typically save 30 to 40 percent of the time spent on this stage.

The ROI: At 10 deals per quarter, that is 80 recovered analyst hours and $6,000 to $8,000 in direct labor savings. More importantly, you evaluate more deals without adding headcount.

Document Review

AI can identify risks and summarize legal and HR documents. Kira Systems, Levity, and ChatGPT Advanced Data Analysis typically save 50 to 60 percent of the time spent reviewing contracts.

The ROI: Document review often runs 40 to 60 hours per deal. Cutting that in half recovers 200 to 300 analyst hours quarterly. The bigger return is risk avoidance. One missed clause can wipe out 10 to 20 percent of enterprise value post close.

Market Intelligence

AI can analyze competitors and sentiment quickly. Perplexity, Grata, and AlphaSense typically save around 30 percent of market research time.

The ROI: Direct time savings are modest at 5 to 10 hours per deal. The real value is speed to conviction. Faster research means quicker IOIs and sharper questions in management meetings, which wins more competitive processes.

Performance Modeling

AI can predict future EBITDA or churn risks based on historical data. Akkio, Polymer, and Runway Analytics typically save 25 to 35 percent of modeling time.

The ROI: Running six scenarios instead of two means tighter bids and better negotiated terms. Even 50 basis points of entry multiple protection across a portfolio compounds significantly at exit.

Where to Start

Pick one category and prove value before expanding.

Document review typically delivers the clearest ROI because the time savings are measurable and risk reduction has obvious dollar value. Run a pilot on one deal, track hours saved, and the math usually speaks for itself.

How Do You Apply AI in the Due Diligence Process?

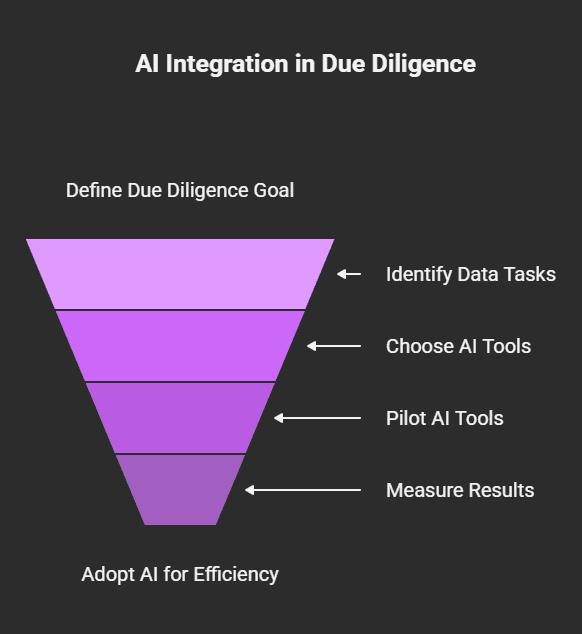

Here is a step by step framework for integrating AI into your next deal.

Step 1: Define the Due Diligence Goal

Ask yourself what decision you need confidence in before investing.

Examples include:

Validating the target's growth sustainability

Confirming customer concentration risks

Assessing operational scalability

AI works best when you anchor it to a single decision rather than a broad request to analyze everything.

Step 2: Identify Data Heavy or Repetitive Tasks

Look for tasks that meet these criteria:

They involve large volumes of documents like contracts, NDAs, or financials

They require pattern spotting across revenue trends or churn data

They involve manual research on competitors or market sentiment

A quick test is to ask three questions about any task.

Can it be defined clearly? Is the input digital like Excel, PDF, or web data? Would summarizing or finding patterns help?

If the answer to all three is yes, the task is ready for AI.

Step 3: Choose the Right AI Tool Category

Here is a simple tool selection guide for deal teams without technical expertise:

For document summaries: ChatGPT Advanced or Levity let you upload contracts and flag key clauses.

For financial extraction: Docsumo or Microsoft Copilot can clean messy spreadsheets automatically.

For market and competitor intel: Perplexity or Grata generate concise market overviews.

For customer sentiment review: ChatGPT with review data uploads can analyze customer feedback patterns.

For forecasting scenarios: Akkio or Polymer let you plug in data and get visual performance insights without coding.

Always test tools with one small project first, such as using AI to summarize the top 10 customer contracts, before rolling them out across your entire business.

Step 4: Pilot and Measure Results

Here is how to run your first AI pilot in due diligence:

Pick one use case such as AI document summaries

Set a time target comparing how long the task takes today versus after AI

Compare accuracy with human output

Decide on adoption if AI saves more than 25 percent of time or improves insights

Ensure to document everything to keep a track of the time saved versus the ROI.

Most mid market firms find two to three times efficiency gains in document heavy tasks within 30 days.

What Are the Best Practical Use Cases of AI in Due Diligence?

Here are ten specific applications you can start using today.

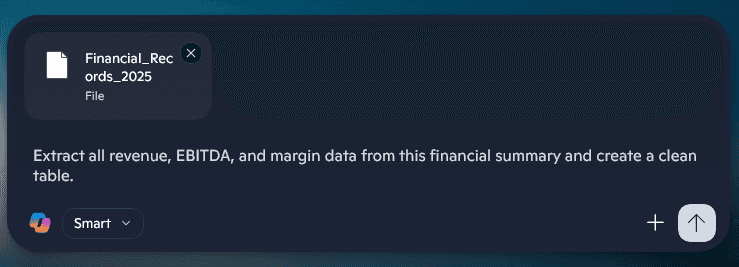

1. Financial Data Extraction and Cleanup

Use Docsumo or Excel Copilot to upload messy financial PDFs and get clean Excel outputs.

Prompt example for ChatGPT: "Extract all revenue, EBITDA, and margin data from this financial summary and create a clean table."

2. Competitor and Market Research

Use Perplexity or Grata to get summaries of top competitors, recent market shifts, and pricing trends.

Prompt example: "Summarize the top 5 competitors for [Target Company] with recent news and market movements."

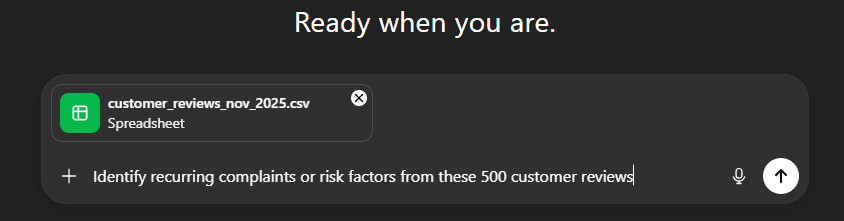

3. Customer Sentiment and Risk Review

Use ChatGPT with CSV uploads to analyze customer reviews or NPS data for recurring issues.

Prompt example: "Identify recurring complaints or risk factors from these 500 customer reviews."

4. Legal and Contract Review

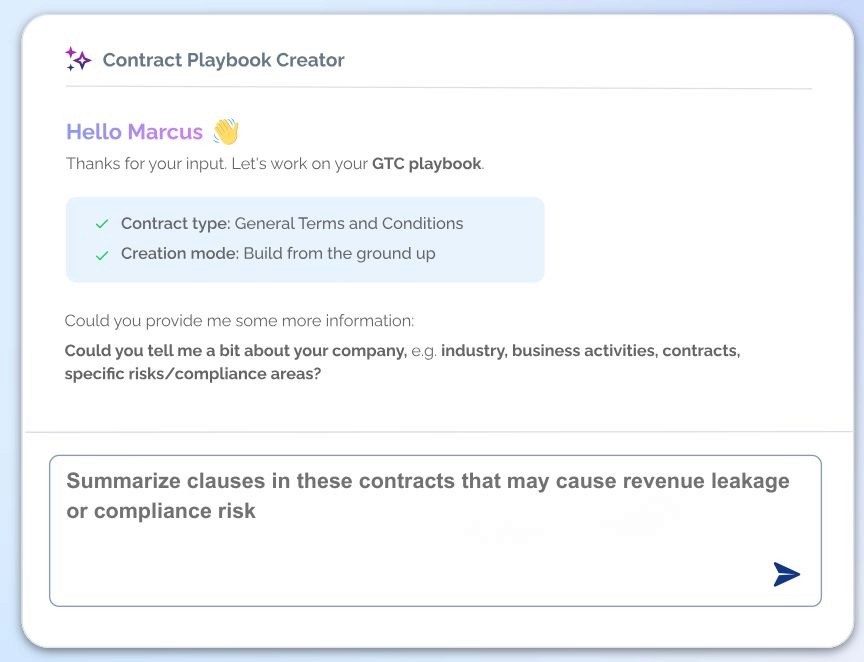

Use Kira Systems, Legartis, or ChatGPT Advanced Data Analysis to upload contracts and highlight renewal terms, risks, and obligations.

Prompt example: "Summarize clauses in these contracts that may cause revenue leakage or compliance risk."

5. ESG and HR Data Scan

Use ChatGPT combined with Docsumo to scan HR data or ESG reports for diversity metrics, turnover rates, and compliance indicators.

6. Predictive Performance Modeling

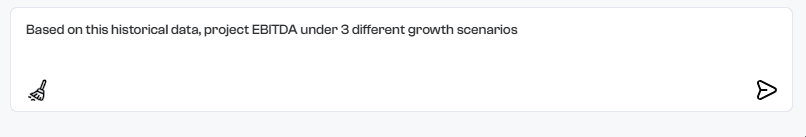

Use Akkio or Polymer to upload past P&L or sales data and forecast the next 12 months under different scenarios.

Prompt example: "Based on this historical data, project EBITDA under 3 different growth scenarios."

7. Deal Teaser and IM Summaries

Use ChatGPT or Perplexity to upload teasers and get key takeaways summarized quickly.

8. Red Flag Detection

Use Levity or ChatGPT to scan documents specifically for risk indicators that might be buried in dense text.

9. Cultural Fit Analysis

Use ChatGPT with web search capabilities to analyze leadership interviews or press releases for tone and strategy consistency.

10. Exit Scenario Modeling

Use Polymer or Excel Copilot to build quick what if models for three to five year exit windows.

How Do You Get Started with AI in Your Next Due Diligence?

Here is a five step launch plan for your next deal cycle:

Pick one focus area such as document review or market analysis

Choose one or two no code AI tools from this guide

Run a two week pilot on a live deal or a past deal for practice

Compare time and quality versus manual output

Create a repeatable checklist for future deals

For a more comprehensive view of implementation, see our guide on how to implement AI in your business.

What Are the Common Mistakes to Avoid When Using AI in Due Diligence?

Trying to automate everything at once. Start small, refine your process, and scale what works.

Blindly trusting AI summaries. Always have a human analyst review key findings before acting on them.

Ignoring data security. Use NDA safe platforms or anonymize deal names before uploading sensitive information.

Failing to measure ROI. Track time saved and accuracy gains for each pilot so you can justify expansion.

Understanding the full AI implementation costs before starting helps avoid surprises and failed projects.

Which AI Tools Work Best for Non Technical PE Teams?

Here is a breakdown of recommended tools by use case:

Document Review: Kira Systems is an enterprise level paid tool designed specifically for contract analysis.

Financial Cleanup: Docsumo is a mid tier paid tool that handles messy financial documents well.

Market Research: Perplexity is free and produces concise, well sourced market overviews.

Predictive Modeling: Akkio is an affordable paid tool that does not require coding.

General AI Assistant: ChatGPT Advanced costs $20 per month and handles a wide range of tasks.

Competitive Intel: Grata is an enterprise level paid tool for deeper competitive analysis.

Visual Analytics: Polymer is affordable and good for creating visual data summaries.

Workflow Automation: Zapier combined with OpenAI offers flexible hybrid pricing for connecting tools.

Right now, you are paying for it in:

Lost Deals (because you moved too slow).

Burned-out Analysts (doing robot work).

Missed Red Flags (buried in data you didn't have time to read).

The cost of fixing this is zero. The cost of ignoring it is your next deal.

Book a 15-minute Efficiency Audit with us. We will identify the single biggest bottleneck in your diligence process and show you the exact way to fix it.

> BOOK YOUR AUDIT HERE

Conclusion: The Future of AI Driven Due Diligence

AI is not about replacing human insight. It is about removing the manual friction that slows your team down.

For mid market funds, this is the difference between running three due diligences per quarter versus six, without adding headcount.

The approach that works is to start small, test with real deals, measure the results, and scale what proves valuable.

By your next deal cycle, your team could spend 70 percent less time collecting data and more time doing what actually drives returns: making better investment decisions.

For a deeper look at how AI transformation works in practice, explore our guide on what AI transformation really means.

Frequently Asked Questions About AI in Private Equity Due Diligence

1. What are the best AI tools for private equity due diligence in 2026?

For document review, Kira Systems and Levity are industry standards. Docsumo and Excel Copilot excel at financial extraction from PDFs, while Perplexity Enterprise offers accurate market research. These tools outperform general consumer AI by ensuring data security and handling complex deal-specific formats.

2. Is it safe to upload confidential IMs to ChatGPT?

No, never upload confidential data to the free version of ChatGPT, as it may train on your data. Instead, use Enterprise-grade environments (like ChatGPT Team or Azure OpenAI) where data retention is disabled, or SOC-2 compliant platforms like Hebbia designed specifically for secure deal analysis.

3. How much time can AI save in the due diligence process?

Benchmarks indicate AI reduces data gathering time by 40–50% and document review by up to 60%. This typically allows deal teams to reach a decision 3–5 days faster. While AI accelerates processing, human analysts are still required to verify findings for the final investment memo.

4. Can AI fully automate LBO modeling?

AI cannot yet build bespoke LBO models from scratch due to deal complexity. However, predictive tools like Akkio and Polymer can run thousands of revenue scenarios and sensitivity analyses in minutes. Analysts can then plug these AI generated forecasts into their core Excel models for greater accuracy.

5. Does a mid-market PE firm need a data science team for AI?

No. The modern private equity AI stack is primarily no-code. Tools like Zapier, Docsumo, and Claude allow investment professionals to build automated workflows—such as summarizing NDAs or cleaning data without writing Python. The barrier to entry is process knowledge, not technical coding skills.

6. What is the difference between Generative AI and Predictive AI in M&A?

Generative AI (like ChatGPT) creates text, summarizes CIMs, and drafts reports. Predictive AI analyzes historical data to forecast future EBITDA, churn, or growth rates. A complete due diligence strategy uses both: Generative tools for qualitative documents and Predictive tools for quantitative financial assessments.